Future of Сryptocurrency: Forecasts on Market Recovery 2024

The bear market, also known as a crypto winter, started at the end of 2021. During this difficult period, all cryptocurrencies have lost up to 99%, and many projects have gone bankrupt. So, only strong projects could survive during these challenging times.

Will cryptos recover? When will crypto recover? Is crypto recovering now? We will answer all that, as the future of cryptocurrency is much more significant than even some holders think. So, let us begin.

What Happened During the Crypto Winter of 2024?

The previous year was not hard just for the crypto market but other financial markets, such as the stock market. For example, the most important index on the US stock market, S&P500, decreased by 17%. As the crypto market is more volatile, the falls recorded were many times greater. The first cryptocurrency, BTC, dropped by 64%; the second currency, ETH, lost 66%, and many altcoins are down more than 90%.

The previous year brought several big crashes to the cryptocurrency market. Let’s review all major occurrences to conclude when crypto will recover after all of this.

STEPN crash

At the beginning of 2022, crypto enthusiasts got acquainted with a new idea of making money. STEPN was the first and the most successful project that allowed its users to earn money while walking. After it, several similar Move-to-Earn projects appeared.

People were so passionate about this project that they sold their property and other assets to buy NFT sneakers and start earning with STEPN. Also, the project had a very successful token sale that gave 400x profit for investors. Its native token, GMT, made it to the top 100 coins, according to CMC.

But after a peak, this bubble burst. As a result, many users lost their deposits and some lost faith in the market.

This big crash taught investors not to rely on one project but to diversify investments and efforts. Also, it is better not to wait for the peak but set profit goals, and when you reach this level, don’t be greedy.

Terra Luna stablecoin crash

The next big crash happened in May 2022 when Terra Luna stablecoin lost its dollar peg and dropped to a fraction of a cent in mere days. It caused the bankruptcy of many large funds that had held UST. In such a way, Three Arrows Capital had been one of the largest and most successful venture capital funds on the crypto market, with $18 billion capital before Terra collapsed.

BlockFi is another lending platform that suffered from the crypto winter, which escalated after the Terra crash.

By then, the market’s capitalization had more than halved compared to its high several months ago.

This crash showed investors that they have to diversify risky investments and the instruments of storing money. It is better to buy several stablecoins such as USDT, USDC, DAI, and BUSD because any of them can face problems.

Ethereum migrating to Proof-Of-Stake

It was one of the most anticipated events of the last few years; nevertheless, when Ethereum eventually switched to PoS in September 2022, it didn’t change the bearish trend and had no impact on ETH price.

Aptos airdrop

New blockchain Aptos changed the mood of the market participants for a while by distributing rewards among its early testers and those who ran nodes of this new blockchain.

FTX crash

After a positive wave, the market saw a new huge collapse of the second-largest cryptocurrency exchange, FTX. It had more than 100 affiliated companies and invested in all major projects of all spheres in the crypto market. As a result, many people lost their belief in crypto and became afraid of the collapse of other centralized crypto exchanges.

Top 7 Bitcoin Predictions

2022 was a challenging year for the whole crypto community, so the most interesting question, for now, is when the crypto market will recover.

Bitcoin is the most popular cryptocurrency; that’s why all other coins follow its trends, so let’s explore its past reasons for growth to find the answer to the main question: “Will crypto recover in 2024?”

Bitcoin is often considered a hedge against inflation, as it is decentralized and is not controlled by any central authority. Moreover, it has a limit of 21 million, which is not subject to inflation like fiat currencies. Therefore, when the value of fiat currencies such as the US dollar decreases due to inflation, the value of bitcoin may increase as more people look for alternative forms of a store of value.

Nevertheless, risk assets such as cryptocurrencies and stocks suffer when Fed raises interest rates. That happens because rising interest rates drain the economy’s liquidity, which hurts risk assets the most. As a result, even top cryptocurrencies and stocks can drop by up to 60%. So, the rate reduction is the factor that can make crypto recover.

Different forecast platforms and top specialists have different opinions on the future of crypto in the next 5 years.

#1 — BTC reaches $27,300 in 2024

Based on the forecast made by PricePrediction, crypto will recover in 2024, and Bitcoin will reach $27,300 this year. Then the positive trend will continue, and its price will likely hit all-time highs in 5 years. As for a longer distance, Bitcoin is expected to reach $394,000 by 2030.

#2 — BTC will be $1 million by 2030

What does the future hold for cryptocurrency? Cathie Wood (founder and CEO of ARK Invest) suggests everyone investigate BTC more precisely, as according to her predictions, it might hit $1 million by 2030.

#3 — Bearish market might go on

According to CryptoPredictions, the bearish market will continue. They expect Bitcoin to fall further in the next years and be around $13,700 in 2025. And the small recovery is expected to be only in 2026.

#4 — The crypto future is dark: BTC will be $10,000

What else do famous investors and crypto enthusiasts say regarding the future of cryptocurrency? Mark Mobius (co-founder of Mobius Capital Partners LLP) predicts that Bitcoin will drop to $10,000 in 2024.

#5 — BTC $13K in 2024

One more pessimistic forecast for 2024 is given by JPMorgan Chase & Co analysts, that expect Bitcoin to be traded at around $13,000 in 2024.

#6 — The Four-Year Cycle theory

Many experts adhere to the theory of the Four Year Cycle. Bitcoin has had a pattern of four-year cycles since its inception: one year of correction (bear market) and three years of growth (one of them is most successful).

According to this theory, bitcoin will have a small growth of 1.5-2X in 2024. And the most considerable growth will either be in 2024 or 2025. And 2026 will be the year of correction (decline) again.

The four-year cycle of bitcoin is explained by the pattern in which the mining reward for bitcoin is halved approximately every four years. The mining reward is the amount bitcoin miners receive for verifying transactions on the network.

As the mining reward is halved, the inflation rate decreases, and the total supply of bitcoin approaches its maximum limit of 21 million. Halving is built into the Bitcoin protocol, which helps control the inflation rate and, ultimately, the total supply of bitcoin. After every halving, there was rapid price growth.

These four-year cycles have happened twice (2014- 2018 and 2018-2021) in the past and are expected to happen again.

Looking at the Bitcoin price chart, we can assume that after a bearish 2022, we will enter the accumulation phase, which precedes a bull market.

#7 — The crypto future promises $30K for a BTC in 2024

Bitcoin started in 2024 with an impressive growth of 30%. Experts consider this rally to be more than just a short-term bounce. According to their predictions, it is the start of a new bull run, so this growth will continue to up to $30K this year.

Several factors explain this positive trend.

- The significant stock recovery over the first two weeks of 2024 is evidence of better market sentiment across risk assets, including digital currencies.

- The macroeconomic situation has eased: Positive inflation news that the CPI dropped monthly and a strong December payrolls report have contributed to allay fears about the worst-case scenarios.

- Crypto adoption and availability: companies develop products that allow everyone access to cryptocurrencies. In such a way, users of Apple Pay can already buy Bitcoin with Apple Pay.

Ethereum Forecast 2024

Ethereum is the second biggest cryptocurrency but still follows the Bitcoin trend. So when the bear market is over, experts expect the growth of ETH that will be even more rapid than the growth of BTC price.

Because of crypto winter, even such an anticipated occasion — switching ETH to Proof-Of-Stake — didn’t affect the price significantly. What is more, this update made the network less decentralized. The crypto community became concerned when there was news on the Internet that 81% of Ethereum transactions were censored.

Transactions were checked for interaction with addresses of Tornado Cash users on the Ethereum network. After the move to PoS, about 57% of blocks on the Ethereum network are verified through MEV-Boost, which complies with US sanctions. It makes it impossible to put these transactions into the blockchain, no matter how high a commission would be assigned.

That ruins the idea of using cryptocurrencies as a decentralized and uncensored means of payment.

Altcoins Forecast 2024

As is known, most alternative currencies follow Bitcoin movements because it is the largest and most well-known cryptocurrency. Consequently, most investors and traders use Bitcoin as an indicator of the overall health and performance of the whole market.

Additionally, because Bitcoin is often used as a means of exchange for other cryptocurrencies, changes in its price can affect the demand for and value of other digital assets. It means that the end of crypto winter and market recovery fully depends on BTC.

During 2022 some altcoins lost up to 99% and faced a series of delistings from centralized exchanges. In such a way, because of regulatory pressure, Huobi delisted 6 cryptocurrencies with enhanced anonymity like Monero (XMR), Dash (DSH), Decred (DCR), and others. Binance, in its turn, delisted all stablecoins apart from USDT and BUSD.

Nonetheless, some alternative currencies hold up well, so the experts are already making predictions on what crypto to buy now to get Xs on the next boom. The life of the market is divided into stages. At the beginning of 2022, the market was in a decline stage, but it went into an accumulation phase. It is the opportunity for all crypto enthusiasts to do new activities from projects and for investors to buy new assets.

What Is the Best Crypto to Buy Right Now?

According to CoinTelegraph, investors should continue keeping their eyes on fundamental cryptocurrencies such as BTC, ETH, and MATIC. These currencies have real use cases and are likely to be used by people through time.

CoinDesk analysts suggest investors pay attention to projects from spheres like Web3, Gaming, DAOs, and NFTs. These spheres attract big companies and brands that see opportunities to improve their businesses and promote their services using these new technologies.

Avoid Scammers when Investing in Crypto

Watch Out! Plenty of new cryptocurrencies appear daily, but most are scams.

Slowmist Hacked and Atlas VPN specialists shared the results of a study, according to which the volume of cryptocurrency assets stolen by hackers from various blockchain platforms was approximately $3.5 billion the previous year.

Numerous crypto thefts brought in $4.28 billion for criminals in 2022. Considering everything of this, it is important not to lose vigilance. Here are some tips to help you avoid scammers.

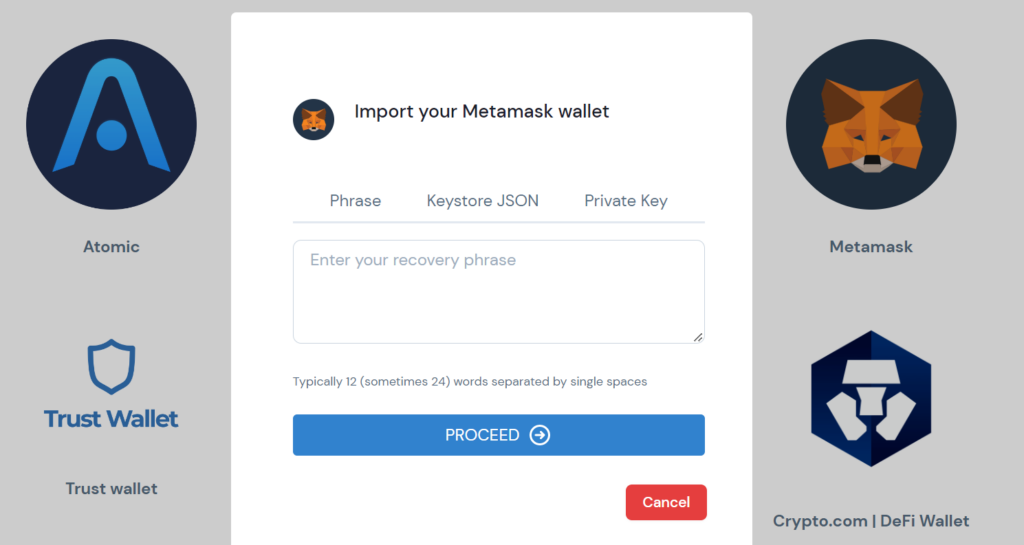

Ignore support service mimics

Never trust people who introduce themselves as a support service for any website and send you personal messages. Usually, they type to you when you ask a question in an official chat of a project on Discord and Telegram. They pretend they want to solve your problem, so they will offer you to go to their website, where you will need to enter your seed phrase or approve token spending.

Do not click links in messages from questionable senders

Scammers may include links or attachments containing malware or phishing attempts in their communications. Be cautious when clicking on links or opening attachments from unknown sources.

Be careful with your info

Never share your seed phrase or personal information, and try not to connect your wallet to untrustworthy websites.

Do your research

Scammers often count on people not doing their research and blindly trusting them. Before investing, try to find as much information from different sources as possible.

Risk management is necessary

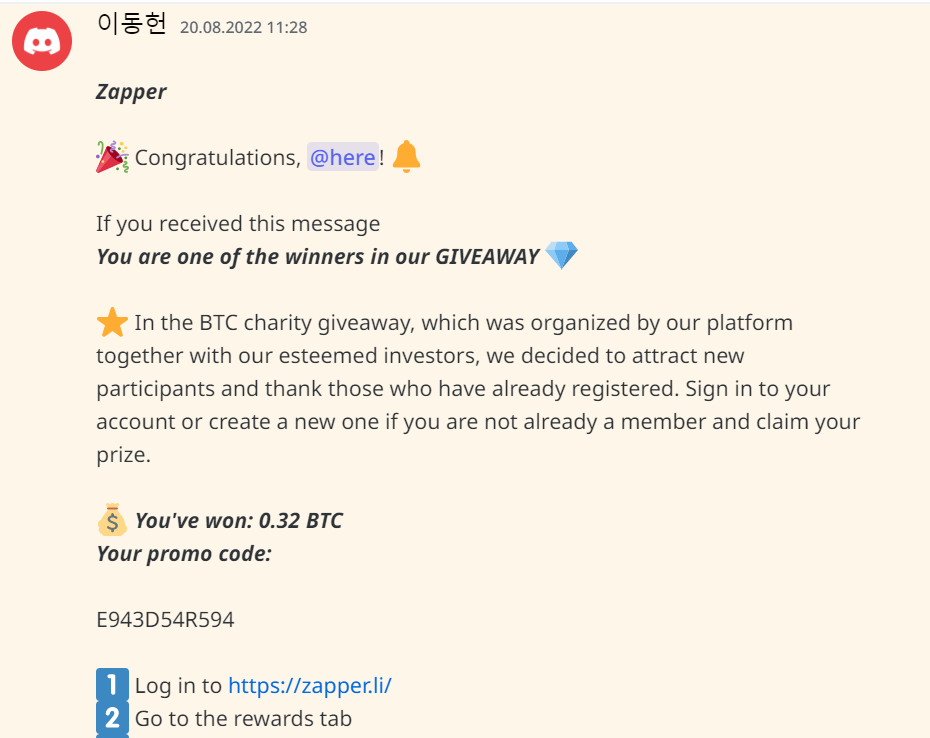

Remember about risk management: scammers often play on human greed. They promise enormous profits without risks but remember that the higher the interest, the greater the risks.

Choose tested and trusted exchanges — solely

Use reputable exchanges and wallets: scammers often use fake or phishing exchanges or wallets to access people’s money.

Crypto Money-Making Activities 2024

For those crypto enthusiasts who are only building up their capital, the market offers different activities to make money in 2024.

Users can participate in testnets, retrodrops, run nodes of new projects, and become ambassadors to help projects in the promotion. All these activities are likely to be rewarded over time.

IDO (Initial DEX offering)

Various projects, before going public, organize token presales. Projects sell their tokens for prices several times lower than what they will be at the global market launch. It is one of the best opportunities to earn in a short period of time.

The income from this strategy comes when the token is launched in exchange at a 5, 10, or sometimes 100 times higher price. Different projects can put forward their conditions to get into such a sale.

For example, they can give such an opportunity to those who will promote their project on various social networks. Also, they can do a lottery, and random participants will get an opportunity to buy tokens at the best price and multiply their investments.

Ambassador programs

The essence of ambassador programs is to help the project in its early stages by creating creative content such as videos, articles, and infographics and putting them on their social media with different thematic hashtags. Projects truly appreciate designers, copywriters, and project managers who answer questions about chats and summarize community calls.

To reward ambassadors, projects may distribute their native tokens, give you some valuable NFTs, allow you to participate in presales at the best prices, in other words, put you on the whitelist, etc.

Usually, to get into such a program, you need to fill out a form where you will have to show your interest in the project, talk about your experience and attach your portfolio.

Testnets

It is one more sphere that does not require any huge investments. In this case, the project needs to have its functionality tested. Thus, testnets are usually conducted by bridges and various DeFi services. After the test, projects usually ask users to leave feedback about what can be improved in their work and interface and what bugs need to be fixed.

Participants can be rewarded with NFTs, native tokens, and an allocation in the presale.

GameFi

GameFi is one more area where you can make money with minimal investment if you get in the early stage. The most popular Play to Earn projects of all time were STEPN, Axie Infinity, and CryptoKitties. These projects pay users for playing.

Crypto gambling

One more thing that may help you to build up your capital quickly is crypto gambling which has become very popular lately because of pleasant welcome bonuses and its anonymity thanks to cryptocurrencies. It is suitable even for newbies as everyone can learn about top strategies and become a pro after some practice.

How to Find New Projects and Activities?

You can find new projects in other projects’ Discord when they have cross-promotion or by following the development of ecosystems and tracking what projects are coming out on them.

Activities offered by projects are usually written on their websites or in their official Discords. But you can also write directly into the general chat with questions about what the project needs help with.

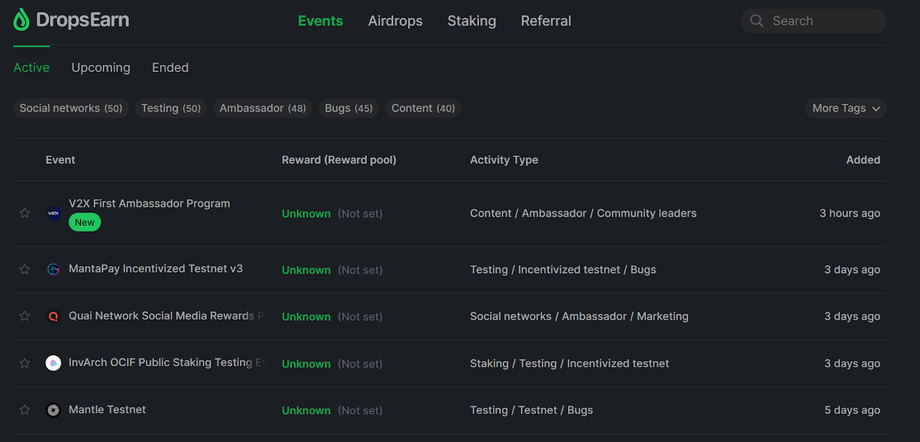

One more way to find such opportunities is to follow some Telegram and YouTube crypto bloggers that make guides on how to take part in different events. Still, suppose you want to learn about all opportunities among the first. In that case, you can monitor activities on your own on different sites-aggregators such as DropsEarn that gather information about new projects and what you can do to make money.

In order not to lose money in scams and not to waste your time on projects that are not likely to pay their ambassadors, you need to learn how to find promising projects.

Top 3 Tips on How to Find Prospective Projects

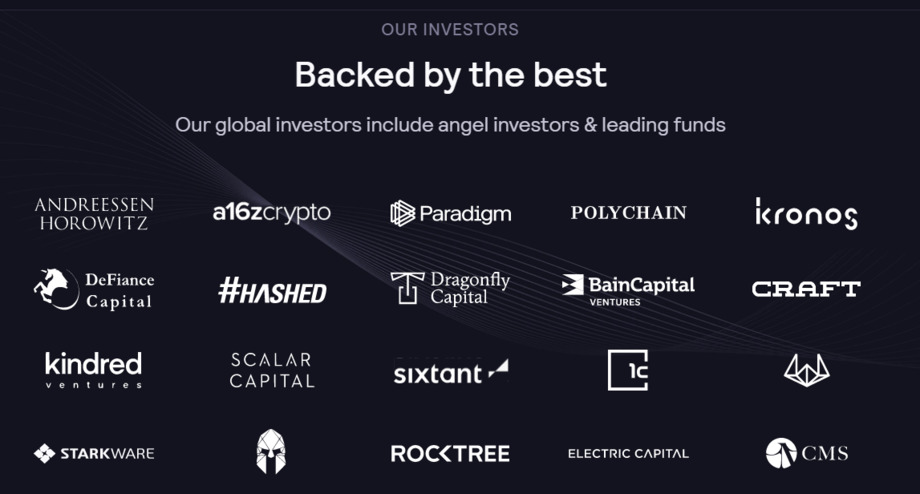

1. Funding analysis comes first

Analyze the funds that invest in the project. This information can be found on the project’s website in the “Backers” or “Investors” sections.

Be sure to double-check this information on the sites of the funds in their “Portfolio” section.

Tech team analysis

Analyze which team is behind the project. If the founder and developers of the project have already had several successful cases in their portfolio, they are more likely to create something worthy and attract top investors.

You can find out more about previous projects of team members on their social media accounts.

Analyze the marketing campaign

You should pay attention to marketing campaigns and social media. You should investigate if there is a big community and if many people trust this project and want to invest.

How Will Crypto Be Used in the Future?

Standard payment method

Crypto will likely become accepted as a means of payment on the Internet and even offline services in shops and cafes. However, some experts still consider cryptocurrency unsuitable to become a new form of money, so they think it will continue to be primarily used as a speculative investment.

At the same time, many specialists support the idea that Central Bank Digital Currencies (CBDCs) will be widely accepted in the future. Countries are currently exploring the use of CBDCs. Some have already made significant progress in developing and testing their digital currencies, which will likely make digital transactions more efficient and secure.

Passive income

Crypto allows people from underdeveloped countries to get access to tools for passive income and protects them from the inflation of their national currencies. Today DeFi allows one to take a loan or make a deposit and earn interest without intermediaries like banks.

Entertainment

Cryptocurrencies are necessary for many games that run on novel technology. Also, crypto has a wide application in the gambling entertainment industry; you can use crypto on gambling sites that accept various cryptocurrencies.

Blockchain becomes a part of all spheres

Blockchain technology — the underlying technology of many cryptocurrencies — is expected to find increasing application in industries such as finance and medicine.

Conclusion: What Is the Future of Cryptocurrency?

According to some specialists, the increasing mainstream acceptance and adoption of cryptocurrencies by institutional investors and businesses will drive the growth of the crypto market. Additionally, they believe that the ongoing global monetary stimulus and low-interest rates will continue to drive investors toward alternative assets like cryptocurrencies, boosting the market’s recovery.

All in all, we should continue to monitor the market situation so as not to miss opportunities. Most leading experts agree that crypto will recover in 2024. As for the future of cryptocurrency, it is predicted that it will hit all-time highs, and according to some specialists, Bitcoin will have reached $1 million by 2024.