Crypto Anarchy: A Dive into the Unregulated Financial Abyss

Did you know that the crypto term is not just about quick, anonymous payments via Blockchain?

Altcoin payments are just a part of a significant and developing ideology called crypto anarchy — with freedom and privacy as the main values. It opened a new era of digital behavior patterns, financial regulations, and FinTech solutions.

In this piece, we will explain what this digital punk idea is about — with the pros and cons of crypto anarchy. So, we’ll discuss the positive changes it offers — and possibly hidden (or not so hidden?) threats.

So let’s dive into the unregulated financial abyss.

Understanding Crypto Anarchy

Okay, let’s begin with what is anarchy after all. Some would say it’s something about chaos and total disorder. The others (say hi to Sex Pistols) will claim it’s about freedom.

Still, whatever connotation you add, anarchy, in a nutshell, is the absence of any governmental authority. So, crypto anarchy is the term’s new meaning that refers to digital freedom.

And here is a detailed explanation:

Crypto anarchy is a political ideology that insists on using cryptography and decentralized networks. The point of the whole idea is to protect the privacy and freedom of individuals and not allow states to interfere in any aspect of life. Digital anarchists believe encryption and peer-to-peer technologies should serve people for more convenient communication, trading, and overall society organization without any third party’s (e.g., authorities) control.

How it started

The idea goes back to the 1980s when hackers suggested a novel vision of cryptography’s potential. This vision implied that the developing cyberspace has a chance to offer some alternative form of social and political organization.

One of the pioneers of this movement was Timothy C. May — a technical and political writer and an engineer at Intel. He was inspired by public-key cryptography and realized that technologies like that might become the first attempt to untighten the government’s control over individuals.

According to May, the government would try to prevent or at least slow down the spread of this tech. And he admitted that it made sense — nobody can deny related concerns such as drug dealing, tax evading, and national security — but claimed the process would keep going.

May has published the Crypto Anarchist Manifesto, with its fundamental principles and goals: you should read it for yourself so that no interpretation semi-tones distort your conclusion.

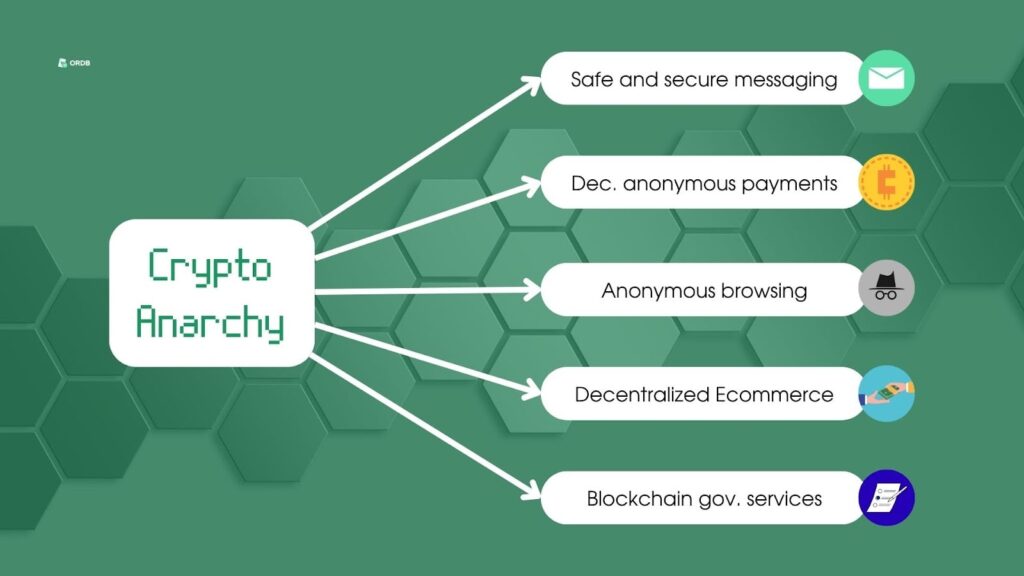

Crypto anarchy principles

In simple words, the idea is that all user data must be encrypted to give people maximum privacy in all their digital activities: from private messaging to financial deals. And, as the term suggests, there must be a safe encrypted space for people communicating, managing businesses, and trading without government involvement. So how to create such a space, and what should it include?

Here are the main principles of digital anarchy, giving a pretty confident reply.

- Decentralization. That means that any power, decisions, or control must not belong to some single authority. Instead, everything should be based on decentralized networks. In digital anarchists’ opinion, such networks appear more transparent and flexible than centralized ones.

Example: national currency is controlled by the government. Some cryptocurrencies, like Bitcoin or Ethereum, are not — they don’t belong to any authority, and any related transactions have no control.

Here is a video that explains decentralization in detail.

- Privacy. This one is about using various cryptographic tools that keep Internet users anonymous. To name just a few — VPNs, digital signatures, security tokens, key-based authentication — anything that ensures a high privacy level.

- Freedom. Another concept of digital anarchy is the principle of individual freedom — freedom to live, financial freedom to trade, and communication in any way anyone wants until it harms anyone else.

Crypto Anarchy Projects and Tools

That all may seem a little romantic. But the reality shows some crypto-anarchist projects already exist and are widely used. Anonymous browsing, VPNs, Bitcoin, and the overall Blockchain network — all of this has become natural for more than 425 million people, and this population keeps growing.

Here are just a few projects that are considered a part of the digital anarchy ecosystem:

The Advantages of Crypto Anarchy

As you see, this is not the ideology promoting anything chaotic or violent — and its central idea is, on the contrary, to support the community and human freedom. And, pretty obviously, the whole concept is opposed to a traditional centralized system.

So what benefits can decentralization bring to society, and why might it be better than what is globally accepted right now?

What’s wrong with centralized currency and data access?

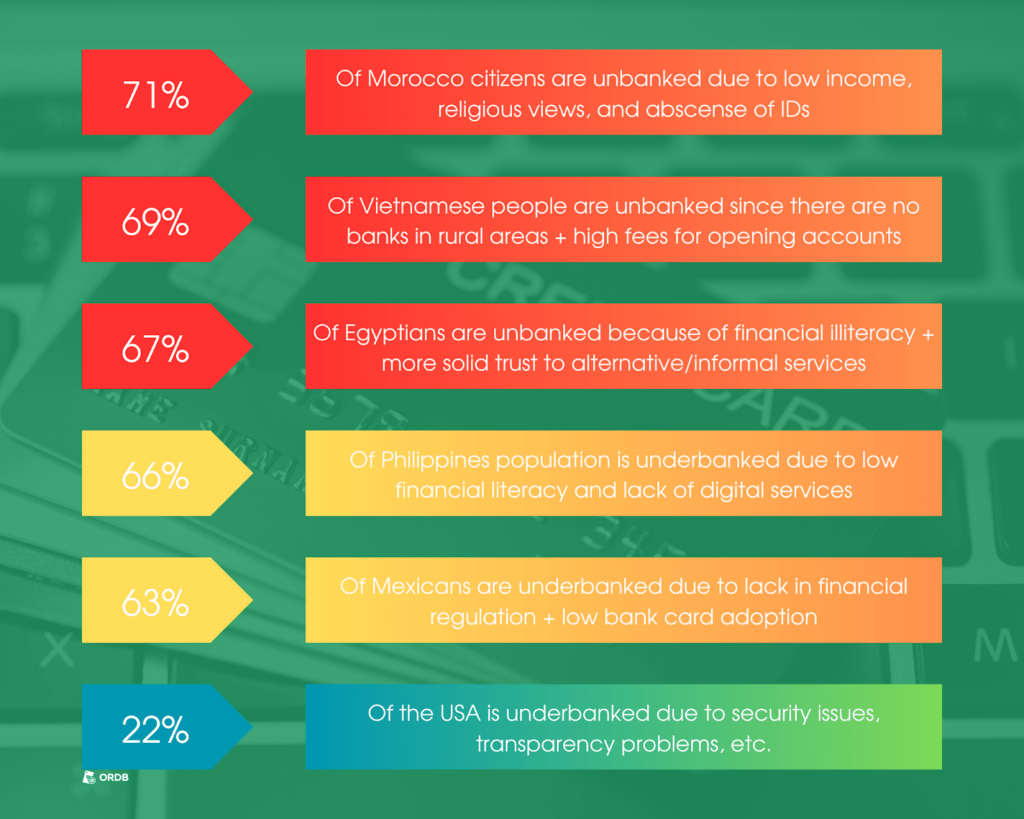

First, there is an underbanked and unbanked population. It means that a big part of society doesn’t have access to bank accounts or other formal financial services — or has, but faces issues with it. And they use informal payment ways for some needs.

For example, Utang is a common practice in the Philippines, and it means borrowing money from friends, relatives, neighbors, or acquaintances. Not the most reliable way to deal with finance, right?

Here is an infographic that can give some understanding of how the underbanked population is widespread in the world:

Besides, any centralization has a risk of political interference or corruption. Pretty logically: when a single authority has the ultimate power, there is a big chance this power will be used for the authority’s benefit.

Returning to the financial freedom concept — the central authority can monitor and restrict the financial activities of individuals and businesses. Not that it always happens in the Big Brother manner, but still — people can’t do whatever they want with their money. Even if it’s not related to any scams or frauds.

Finally, what about innovations? Suppose you decide to run a financial startup. In that case, you might be simply devoured by limits or regulations imposed by authorities — and the most prominent players that this authority benefits from will do just fine.

Guess what we are getting at?

Right. Digital anarchists believe that creating new measures can help combat these issues.

How can crypto anarchy solve the issues?

Without further ado, we’ll just explain the benefits of decentralized financial systems and crypto anarchy.

The Dark Side of Unregulated Finance

However, of course — and anarchists admit it — there are certain and measurable risks and challenges.

People are inventive enough to go far beyond positive intents when they can stay anonymous. Just imagine, it’s like wearing Cap of Invisibility in real life — but in the digital world.

So the risks of unregulated finance are pretty obvious.

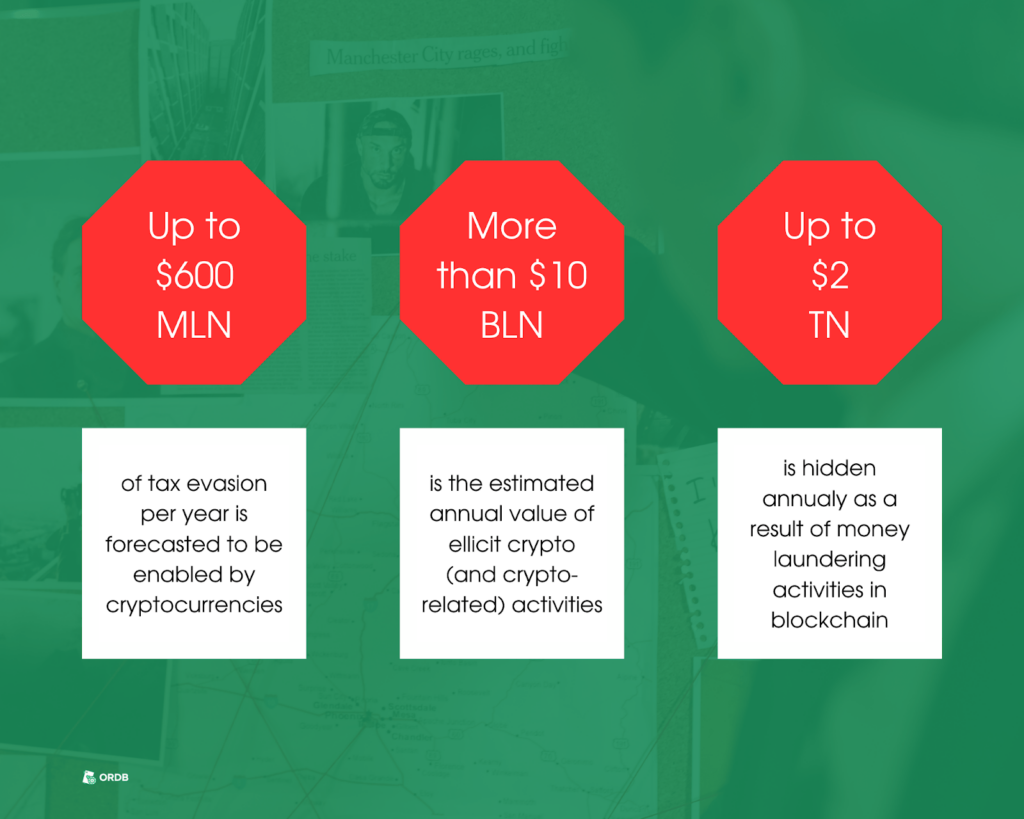

- Crypto scams and fraud Unfortunately, digital coins have created new opportunities for fraudsters. Blockchain-related scams can come in plenty of forms: from fake crowdfunding projects to hacks and cyber attacks on cryptocurrencies stored in blockchain-based wallets.

- Illicit activities in the crypto space Anything illegal like drug trafficking, human trafficking, selling weapons, or other contraband. As most altcoin transactions can be tracked, Blockchain has become the primary tool for such activities.

- Tax evasion Receiving and storing the whole or part of the income in anonymous wallets is a perfect way to hide the actual amounts of tax you need to pay. Yes, crypto-anarchists vote for tax-free governments — but while there are none, it’s still a crime, right?

- Money laundering Just like with tax evasion, money laundering is significantly facilitated by Blockchain technology.

- Terrorist financing Yes, Bitcoin and other similar currencies have also become the best way to make sponsoring terrorists quick and easy — whatever sad it may sound.

And here are some stats to support what we said:

What Do Authorities Think of Unregulated Finance?

As the research shows, all these ideas, specifically decentralized finance (DeFi), pose a challenge to formal — e.g., centralized — banking systems.

What are these challenges, in general, and what is the impact of crypto punk on financial institutions?

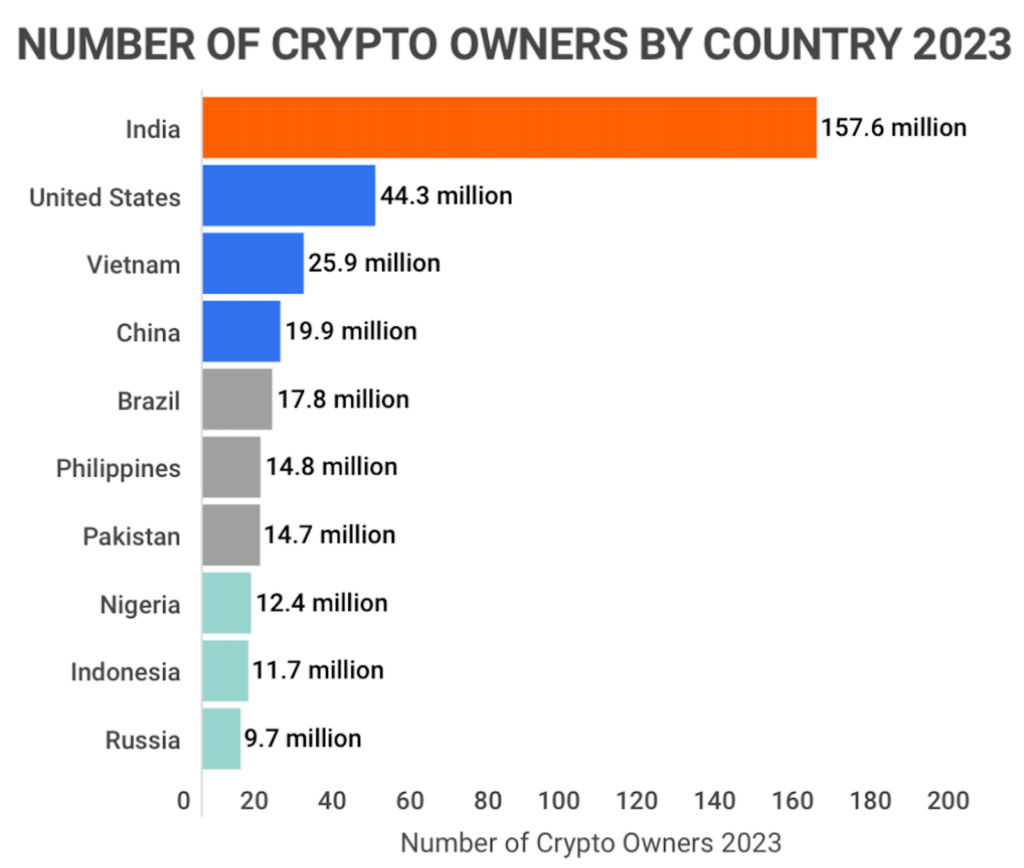

Although alternative coins are still a relatively small part of the global payments landscape, it is rapidly growing. Here is how the number of Blockchain users grows worldwide annually (in millions):

Government oversight in the crypto space: any attempts to regulate it?

No authority can just accept unregulated environments around. However, it’s not that easy to simply come up and introduce new laws, at least because they will contradict the overall cryptoanarchy concept.

With the government’s desire to license Blockchain service providers and establish at least partial control over related activities, the process cannot be quick and smooth.

Still, some attempts were made, of course — from both banking institutions and authorities.

What did banks do?

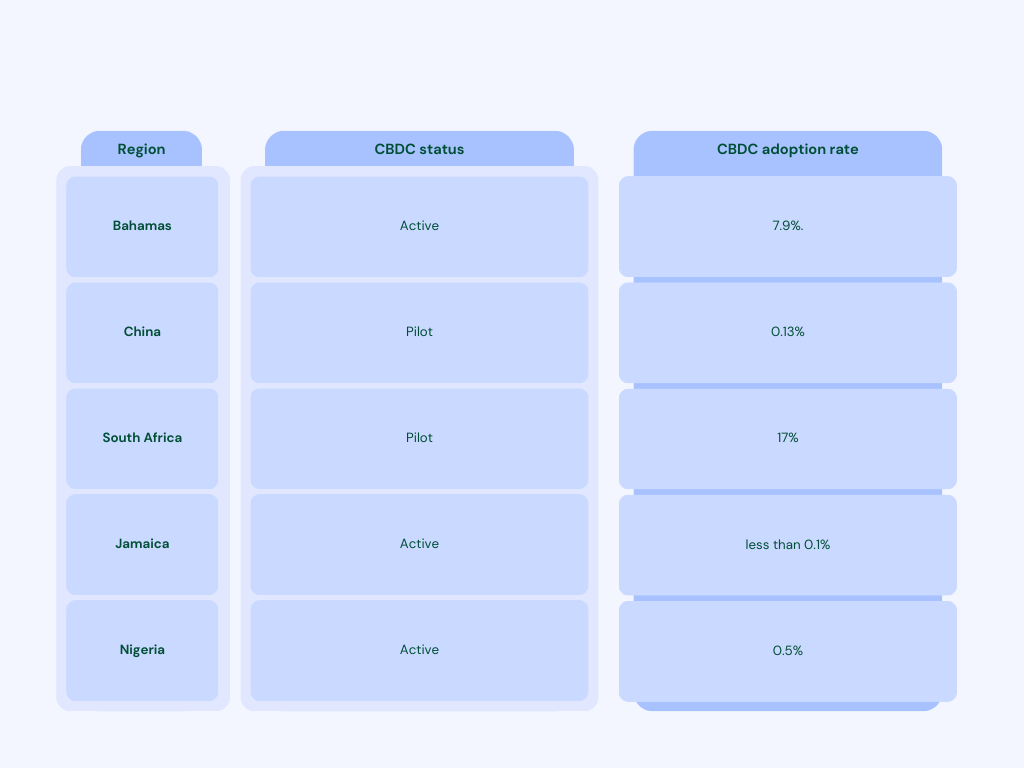

You probably got it right already — they began considering central bank digital currencies (CBDCs). In simple words, these currencies are a digital version of national fiat. Their main advantage is they can provide users with all the Blockchain benefits: accessibility, quick transactions, and convenience. At the same time, CBDCs won’t face crypto-related issues like legality or lack of control.

At the moment, most countries are just doing their research on the topic — and only a few have introduced the pilot versions of CBDCs, which have pretty low penetration, by the way:

What did governments do?

Currently, the attempts to regulate Decentralized Finance (DeFi) can be mainly described as “creating various frameworks and making legislative proposals.”

We prepared a table that will show some examples of cryptocurrency regulations in various countries.

| Jurisdiction | Crypto legal status | Comment |

|---|---|---|

| European Union | Legal, with various regulations and taxation depending on the country | The package of proposals “Markets in Crypto-Assets Regulation (MiCA)” is waiting for approval in 2024. |

| United States | Legal, is a subject of taxation; regulation depends on the state | Some states don’t have specific rules. The others require licenses for any crypto-related activities. |

| China | Illegal | China banned all crypto activities and is actively working on developing CBDCs |

| South Africa | Legal | SA allows purchasing goods with altcoins for now. Besides, there is a regulation framework looking for approval. |

Most countries currently have the following stance: cryptocurrencies are not legal tender, meaning you can’t use Bitcoin or Tether to pay your mortgage or loans. However, it’s allowed to trade and exchange crypto and purchase goods with altcoins.

To Sum Up

So, a summary: crypto punk is a revolutionary idea of a free society that widely uses cryptography and decentralized technologies. This concept involves a range of risks: from threats to formal financial systems to increased cybercrime.

The future of unregulated finance remains pretty vague. Still, there is one sure thing about this anarchy. It inspires new technical, financial, and political solutions — and will keep doing so.

If you got curious about everything we said — don’t miss out on our next posts to stay tuned and have an opportunity to make things different.