How To Short On FTX: The Ultimate Guide On Short Selling Crypto

If you’ve ever dealt with crypto trading, you must know how insanely volatile the market is. During the day, the rates of many coins can change dramatically. Along with volatility, traders’ reactions to events in the world may lead to rapid market collapses, causing significant losses. As a result, some can hit the jackpot, like in a casino, while others can lose their hard-earned money.

To prevent losses, experienced traders opt for short selling crypto. The easiest way to short-sell cryptocurrencies is to head down to a cryptocurrency exchange like FTX, Coinbase, or Kraken. With relatively low entry barriers compared to other platforms, millions of traders considered FTX a more appealing option.

This post will explore what long-short game crypto is all about and how to short cryptocurrency on FTX.

*Note that in November 2022, both FTX and its American subsidiary FTX US filed for bankruptcy, and their websites are not operational at the moment of writing this post.

Shorting Crypto Explained

Before getting into the specifics of short-selling crypto on FTX, let’s start with the basics — the shorting crypto meaning, how to short a crypto coin, the benefits of short selling, and the risks involved.

What is short trading crypto?

To understand the concept of “shorting,” you need to know what long and short positions are in the crypto market. “Long position” assumes the purchase of a cryptocurrency when its price is expected to rise.

Now, what is a “short position” in crypto? Cryptocurrency shorting is a trading strategy involving selling crypto coins to buy them back at a lower price later. This strategy makes sense when you believe the cryptocurrency is overvalued and expect its price to drop soon. If your assumptions turn out to be correct, you profit from the difference in the selling and buying prices.

Often, a trader doesn’t own the cryptocurrency they plan to earn. Due to steep minimum account asset requirements set by trading platforms, traders borrow crypto from the exchange to speculate on the drop in a coin’s price.

Let’s illustrate the shorting crypto meaning with an example. Say you plan to sell one Bitcoin for $25,000 as you expect its price to drop in the next few days. So, you borrow Bitcoin from an exchange and sell it for $25,000. A few days after the sale, BTC’s price drops to $20,000. Then, you buy one Bitcoin back for $20,000 and return it to the exchange. Thus, you earn $5,000 less the interest charged by the exchange for lending you funds.

Why short sell crypto?

Now that you know how to long and short crypto, let’s see why short-selling crypto may be your go-to strategy.

Price difference

Sometimes, the coin price may be significantly overvalued for some reason. Whenever you recognize such a situation, you can take advantage of it by shorting a cryptocurrency and waiting for its price to fall.

Volatility

While volatility can turn off cautious investors, others capitalize on it. As cryptocurrency prices rise and fall, these fluctuations attract risk-averse traders. Still, the short trading strategy requires a proper level of experience and knowledge of trends.

Risk hedging

Volatility negatively affects long positions. If you have a crypto in your portfolio and expect its price to fall, you can open a short position on this coin.

If a price drop occurs, the short sale profit can cover the losses on a long position. Simply put, hedging helps reduce the risks of trading in a bear market.

Risks involved

While shorting cryptocurrencies can be as rewarding as crypto gambling, this trading strategy comes with certain risks. Let’s look through them.

Unlimited losses

If you buy a cryptocurrency to sell it for a higher price in the future (a long position), the only risk you are facing is that its price won’t rise to the expected level. The asset remains with you.

Unlike going long, short selling crypto involves limitless possible losses, especially given the leveraged trade. If a coin’s price rises without stopping, you might have to borrow it again to cover expenses without loss, but at a higher price.

Margin

Remember that when shorting a cryptocurrency, you don’t own it. You borrow it from a broker and pay interest based on the lending rate until you repay your loan. The longer the position is active, the more interest you will pay. If the price of the coin doesn’t match your forecast, you might have to hold it longer than planned.

FTX Overview

Established in 2018 and collapsed in 2022, FTX was the number one option for many crypto traders. Along with spot margin trading, FTX offered various innovative products like cryptocurrency derivatives and leveraged tokens.

Can you short cryptocurrency on FTX? While FTX.COM was unavailable to US residents, American traders could short sell crypto through FTX.US — an American subsidiary of FTX.

How To Short on FTX: Your Options

If you compare FTX VS Bitmex or Binance, you will find a wider range of trading options on FTX. Let’s see how to short cryptocurrency on FTX and benefit from its price drop.

Margin trading

The most popular way to short crypto is margin trading. On FTX, users could trade all the top cryptocurrencies. On FTX, you could get into margin trading without spending a fortune. The exchange allowed traders to invest a small amount (the contribution known as the initial margin) and borrow the rest. Your initial margin must be at least 10% of the total leveraged trade value.

You sell cryptocurrency at a certain price through leveraged trade and buy it back once the price drops. Then, you return the borrowed amount and pay the borrow fees to FTX.

Futures

With futures, you can purchase cryptocurrencies by signing a contract. The contract specifies the selling price for the crypto and when the sale will happen. FTX supported trading perpetual futures contracts in all major cryptocurrencies.

When buying a futures contract, you are betting on a coin’s price growth and profiting from this asset in the future. When selling a futures contract, you expect the price to drop against a general market decline.

FTX allowed traders to leverage up to 20X of their contribution to trade futures. For example, if you had $1,000 to contribute, you could open a leveraged position of up to $20,000.

Options

Another way to short cryptocurrency on TFX was to buy put options. Such options give you the right to sell the coin at a predetermined price (strike price) on a specified date. If, after the specified period, the coin’s price falls below the strike price, then the purchased put option will bring you profit.

Still, the option doesn’t oblige you to sell it. So, if the price doesn’t fall, you only lose the premium — the fee paid for buying the option.

Leveraged tokens

FTX was the first crypto exchange to introduce ERC20-based leveraged tokens. These tokens provided traders with leveraged access to crypto assets and involved no margin requirements. Whenever traders brought tokens, the exchange opened positions in perpetual futures. If these positions made a profit, the price of leveraged tokens increased.

At FTX, you can find 4 types of leveraged tokens available for all cryptos supported:

- BULL (3X)

- BEAR (-3X)

- HALF (1/2X)

- HEDGE (-1X)

With the tokens 2-4, your earnings would be inversely proportional to the crypto’s price increase. So, if the coin’s price rose by 1%, BEAR would drop by 3%, and vice versa. BEAR, HALF, and HEDGE were short leverage tokens, while BULL was a long leverage token.

MOVE Contracts

MOVE contracts are another unique feature of FTX. These futures contracts reflect the underlying asset’s value change since the contract’s start. Whenever the price of the cryptocurrency changes relative to the strike price, the value of MOVE increases. If the price of the coin returns to the strike, the value of MOVE falls.

Let’s see how to short a crypto coin on FTX with MOVE contracts. Suppose a MOVE daily contract is worth $1,000, the strike price is $24,000, and the crypto price is $24,000. When the coin’s price rises to $25,000 and the MOVE price rises to $2,000, you are selling one MOVE. Later, the price of the cryptocurrency drops to $23,500, and the MOVE drops to $1,500. So, you get a profit of $500.

Eligibility requirements

To qualify for margin trading at FTX, you had to deposit at least $100,000 to your account (either in fiat currencies or in crypto). FTX required you to have either $5M in assets as an individual or $1M as an entity if hedging.

KYC procedures

FTX had tiered KYC procedures, with withdrawal limits and access to specific features varying across different account levels. You had to undergo an advanced verification level to qualify for margin trading.

To start short sell crypto on FTX as an individual, you had to provide the following:

- Your personal information (legal name, date of birth, and place of residence)

- A photo ID

- Your SSN

- Proof of your address (e.g. specified on a utility bill)

- Proof of the source of funds.

Once you have your account set up, you need to enable spot margin trading from the settings menu.

How To Short Selling Crypto On FTX 2022 – Full STEP-BY-STEP GUIDE

Trading Fees

FTX implemented the maker-taker model on its platform. Maker fees apply whenever your trade order adds liquidity to the exchange’s order book. If your order takes away liquidity, then taker fees apply. The actual fee depends on your 30-day trading volume — the greater the volume, the smaller the fee. With spot margin and futures contracts trading, maker fees ranged from 0.01% to 0.02%, while takers fees ranged from 0.04% to 0.07%.

When trading leveraged tokens, FTX charged a creation and redemption fee of 0.10% plus a daily maintenance fee of 0.03%.

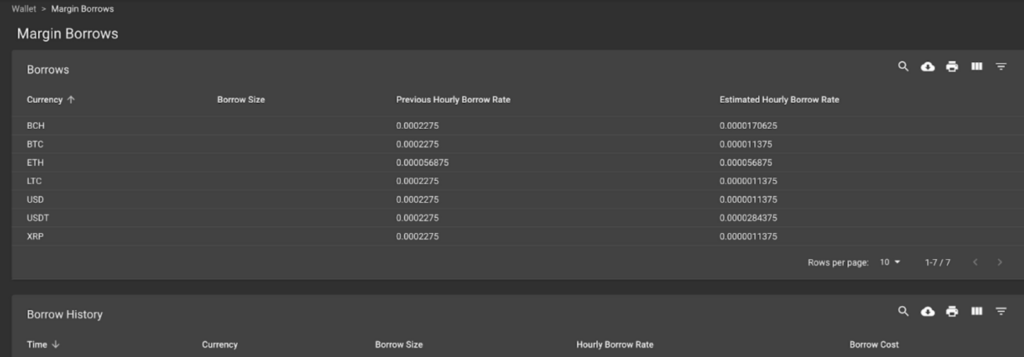

Borrow rates

On FTX, users could lend their spare crypto to their peers on the platform. So, lenders determine the interest rate at which you will borrow money. With leveraged trade, hourly interest rates apply.

Deposit and withdrawal fees

FTX didn’t charge any deposit or withdrawal fees to its clients. Still, network transaction fees and mining fees applied. These fees are dynamic and depend on the current network conditions.

How to Short Crypto in US Market?

You can short sell crypto on certain platforms if you reside in the United States. But, depending on the platform, the available ways of shorting crypto may vary.

Can you short on FTX US? Before its collapse in 2022, FTX US provided US residents with access to margin trading, futures, and options, as well as their innovative products like leveraged tokens and MOVE contracts. Since then, the exchange doesn’t welcome new users anymore.

Binance.US doesn’t support margin trading, while Poloniex and Bitmex are prohibited for US citizens. US residents can still margin trade crypto on platforms like Kraken, Coinbase Pro, and Bitfinex. Margin trading on Kraken comes with certain restrictions, though — following US law, a trader must qualify as an “Eligible Contract Participant (ECP).” On Coinbase Pro, margin trading is available for traders in 23 states.

Futures and options can be viable alternatives to margin trading. Residents of any state can buy options on futures contracts.

Final Notes

Having pioneered the crypto derivatives trading industry, FTX has quickly become a favorite among crypto enthusiasts. Its innovative trading products provide a range of ways to short sell crypto. Competitive trading fees and attractive leverage opportunities made FTX stand out from other exchanges.

While you cannot short cryptocurrency on FTX at this time, you can choose from alternative ways to speculate on the coin’s price drop. We hope the insights revealed in this article will help you short cryptocurrency with minimal risk. Good luck out there!