Tax Reporting Cryptocurrency Guide 2024

Taxes on crypto? Excuse you?

Yes, your cryptocurrency holdings, including Litecoin, Ethereum, and others, are taxed. The rules outlined in this guide apply to any taxpayer who owns or trades virtual currency — meaning, anyone investing or holding virtual currencies must ensure that their activities are reported for compliance.

It’s highly recommended that experienced traders, and more novice investors, review the regulations annually due to potentially significant changes from one year to the next. And here is everything a crypto income haver must know regarding taxes on cryptos.

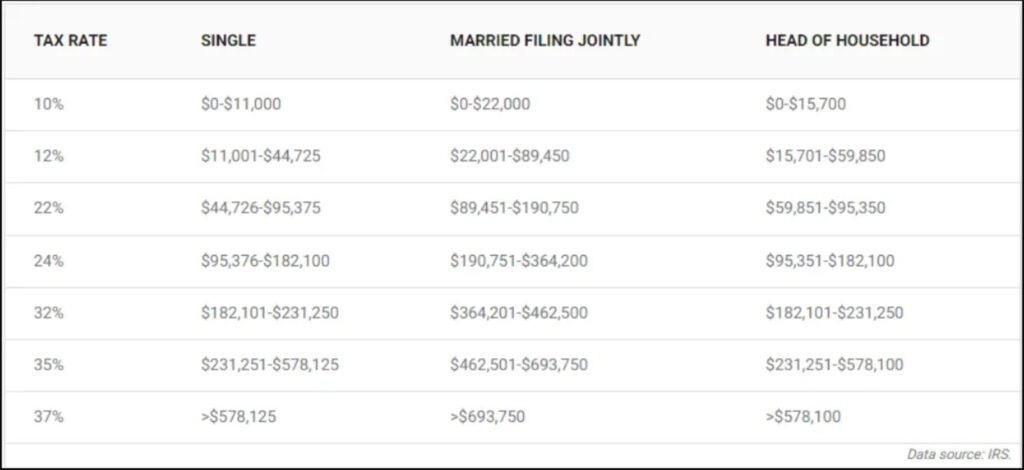

Crypto Tax Rates for 2024

Single tax

The concept of a single tax on crypto has gained traction in recent years as crypto use rises and governments have begun to introduce taxes on crypto assets. That type of tax brings much-needed stability and consistency to crypto taxation, offering clarity for crypto owners when it comes to working out their crypto tax.

Single taxes on crypto can be beneficial, for example, for crypto gambling operations. Depending on their situation, investors may have to file multiple forms or report several things related to crypto to stay up-to-date with their taxes efficiently. Investors should ensure that they know all relevant crypto taxation details, ultimately making single tax reporting the most reliable and easier route for filing any tax requirements on cryptocurrency holdings.

Married filing jointly

When it comes to crypto and taxes, filing jointly as married couples can be extremely beneficial. For married couples looking to file their crypto tax, filing jointly can be a wise option.

Filing jointly can create various opportunities for savings on crypto tax returns by streamlining the reporting process and offering additional deductions that wouldn’t necessarily be available if filing separately. This strategy is especially beneficial for married couples that share finances or have earned cryptocurrency income, as you’ll only have to prepare and submit one combined crypto tax return, thus resulting in lower processing fees and fewer resources to agree.

Ultimately, a joint filing could help save time and money regarding your crypto tax return, so it’s worth considering if this option is suitable for your financial situation.

Head of household

Understanding crypto tax and taxes on crypto as the Head of Household can be daunting. The most significant thing regarding tax reporting cryptocurrency gains is to make estimated payments on crypto gains throughout the year or face penalties if you need to pay more taxes when filing your return.

For example, those filing as a head of household can claim a standard deduction of up to $18,000 for federal taxes and qualify for certain tax credits. Taxes on crypto filers who meet the head of the household status criteria can also take advantage of some tax relief strategies. Depending on their income and investments, they could benefit from deductions related to tax-loss harvesting and activities like trading crypto gifts and capital losses.

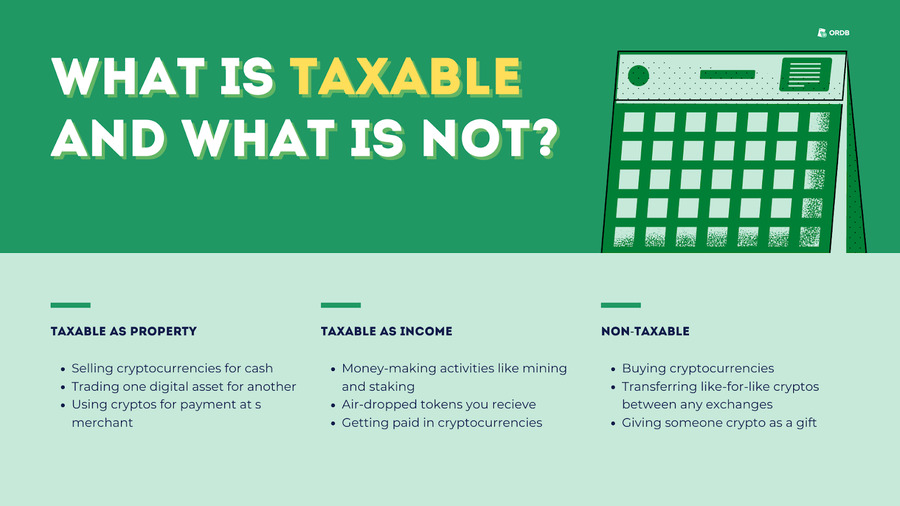

What Taxes Do Cryptocurrencies Incur?

If you’re thinking of investing/mining/winning in cryptos, remember the different taxes on crypto that may apply. In many cases, cryptocurrencies are subject to capital gains tax. That means that if you sell your coins for more than you paid, you’ll need to pay tax on the profit. Other crypto taxes may apply, so it’s important to do your research before investing.

You may be subject to the currency transaction tax if you trade

If you are trading cryptocurrency for another currency, such as the US Dollar or Euro, you must be aware that you may be subject to a currency transaction tax. That means you must accurately report crypto taxes when filing with your tax authorities to stay compliant and avoid penalties.

Trading crypto brings an added layer of complexity when it comes to tax reporting cryptocurrency, so make sure that you understand regulations and how they apply to your trades to ensure that you meet all legal requirements.

Sales tax if you use cryptocurrency to purchase goods or services

The crypto world has changed drastically over the last decade and is now an important part of many people’s financial lives. A major issue with crypto, especially regarding taxes, is that crypto users must pay taxes on crypto used for purchasing goods or services.

Suppose you are using cryptocurrency as a means of payment to obtain a good or service. In that case, you can treat it like any other dollar — you must report crypto used for purchases on your taxes and subject yourself to applicable crypto tax laws. It’s easy to underestimate the importance of crypto taxes, but paying attention to crypto tax regulations is crucial so that you don’t incur any penalties.

Failure to pay crypto taxes can result in hefty fines and possibly criminal charges depending on the jurisdiction of the residence. Taking crypto taxes seriously ensures your finances are in order and compliant with all relevant laws. Remember that using cryptocurrency for goods or services could require filling out an additional tax crypto form beyond the usual 1040 return.

NOT subject to value-added tax

Cryptocurrency is becoming increasingly popular, but it is important to remember that it is not legal tender in most countries. Therefore it is not subject to value-added or sales tax.

However, crypto tax reporting does exist, which requires individuals and businesses who transact with cryptocurrency to declare any profits or losses made during these transactions for taxation purposes. Crypto tax differs from country to country, so it’s essential to know the applicable laws when engaging in cryptocurrency trading.

In addition, several crypto tax software products have become available on the market recently, helping streamline the tax reporting cryptocurrency process.

Self-employment tax obligation is entirely possible

For crypto enthusiasts, understanding crypto and taxes is a must. Crypto has changed how people around the world move money, and just like with any other income, crypto earnings require tax reporting. Any crypto mining income you generate could be subject to crypto taxes, including Social Security and Medicare.

Therefore, if you’re mining crypto and earning a profit, make sure you pay what you owe to the IRS by reporting your crypto profits accurately and on time. Keep crypto taxes from catching up with you — in some cases, failure to report crypto earnings can lead to hefty penalties.

Guide on Tax Reporting Cryptocurrency

Taxes cryptocurrency are a relatively new phenomenon, and the tax implications are still being sorted out. However, you can do a few things to ensure you comply with the law. We’ll walk you through everything you need to know about reporting crypto earnings on your taxes.

Do not try to outsmart the law

It is important to understand what tax reporting cryptocurrency means. In general, cryptocurrencies are taxable property for tax purposes, rather than “actual currency” like dollars or euros. That means any profits from trading cryptocurrencies will be subject to capital gains tax and must be reported accordingly on tax returns. Furthermore, if you use your crypto assets to purchase items or services, you must include this as income and report it on tax forms.

Cryptocurrency is virtual or digital money that is secured by cryptography. It operates on decentralized peer-to-peer networks, and no governmental entities or banks are involved in processing crypto transactions. A major benefit of crypto is that it allows users to remain anonymous while transferring money globally and quickly.

Additionally, tax reporting crypto requires special attention as the Internal Revenue Service (IRS) considers crypto a property subject to taxation. Therefore, if you plan to buy, sell, exchange crypto or receive crypto as payment, it is important to know your crypto tax responsibilities and ensure you comply with the latest regulations.

Understand how to calculate your cost basis in cryptocurrency

Calculating your crypto earnings sounds complicated, but it doesn’t have to be. To help you get started, here are the steps you need to take.

Step 1: Determine the entry price

The first step is to determine the amount of money you invested in the cryptocurrency when you bought it. That is your entry price. If you are buying multiple coins at different times, take note of each purchase price to track your profits from each specific coin accurately.

Step 2: Calculate the exit price

The next step is determining the money you received for selling the cryptocurrency. That is the exit price. Again, if you are selling multiple coins at different times, take note of each sale price to track your profits from each specific coin accurately.

Step 3: Calculate profits/losses

Now that you have determined each coin’s entry and exit prices, it’s time to calculate your profit or loss on each investment. To do this, subtract your entry price from your exit price and then multiply the result by the number of coins purchased.

For example, if you purchased 5 tokens at $100 apiece and sold them for $150 apiece, your total profit would be ($150-$100) x 5 = $250. Once again, if you are investing in multiple coins at different times and prices, calculate the profit or loss for each one so you can get an accurate picture of how well (or poorly) they performed.

Step 4: Calculate the total profit/loss

Now that you have calculated either a profit or loss for each investment, it’s time to sum these into one total figure. To do this, add up all the individual profits and losses from each investment and deduct any trading fees, such as commission or exchange fees.

The resulting figure will indicate whether or not investing in cryptocurrencies has been profitable for you over a certain period. Then you know exactly what kind of returns — if any — you have made overall on all your investments in cryptocurrencies.

Know the difference between short-term and long-term gains when it comes to taxation

When calculating crypto tax returns, it is important to understand that short-term and long-term gains are different when calculating taxes on crypto.

Short-term

A short-term gain is held for less than one year before being sold. For example, if you buy stock on January 1st and sell it on December 31st of the same year, that would be considered a short-term gain (or loss). Short-term gains are taxed at ordinary tax rates on income — the same rate for wages and salaries. That means that if you are in the highest tax bracket, you will pay up to 37% in cryptocurrency taxes on these gains. However, if your taxable income falls under certain thresholds, you may qualify for a lower tax rate depending on your filing status.

Long-term

On the other hand, a long-term gain is held for more than one year before being sold. Any capital gains made over this period can be taxed at lower rates than ordinary income tax rates (which vary depending on your filing status). The current long-term capital gains rate varies from 0% — 20%, with an additional 3.8% surtax applicable to certain taxpayers who have high adjusted gross incomes (AGI). Long-term capital gains are also not subject to state or local taxes; however, they can still be subject to federal taxes, making them far more advantageous from a taxation standpoint than short-term gains.

Find out what records you need to keep for reporting crypto tax

It is necessary to properly report any taxes on crypto, and understanding the tax requirements of owning this digital currency is therefore essential. To ensure tax compliance, you must keep as many records as possible of your cryptocurrency transactions, such as copies of purchase or receipt information and your wallet address.

Other documents you may need include tax records of cryptocurrency donation transactions, income tax returns or unemployment benefits deposited in crypto form, and any other crypto-related documentation that could impact your tax liability. By taking the time to understand exactly what records are necessary for reporting crypto taxes for crypto-assets, you can stay informed and avoid any potential problems with the IRS when filing taxes.

Find what forms need to be filed when reporting crypto taxes

Keeping up with crypto tax reporting can seem difficult and confusing, but there are a few basic steps taxpayers need to take when filing crypto earnings on taxes.

Form 1099-K

If you are a self-employed individual who has sold over $20,000 worth of cryptocurrency and has made over 200 transactions, then you must fill out a Form 1099-K for taxes crypto. This form is used to report income from cryptocurrency exchanges and includes information regarding your gross income and total sales of your crypto assets. This reporting crypto taxes form also includes information about any fees charged by the exchange platform.

Form 8949

If you are an individual investor, you must fill out Form 8949, which is used to report capital gains or losses from selling or exchanging cryptocurrencies. This form requires information about each transaction, including the date of acquisition, sale or exchange, cost basis, proceeds received, and any gain or loss associated with each transaction.

Form 1040 Schedule D

This taxes cryptocurrency form is used for reporting capital gains or losses from the sale of cryptocurrencies and must be completed in conjunction with Form 8949. It should include information such as total net capital gain or loss, the long-term capital gains tax rate applied, the short-term capital gains tax rate applied, and total taxable income after adjustments for deductions and exemptions. Information reported on these two forms must match the IRS to process your taxes correctly.

Schedule 1

Once you’ve filled out Form 1040, you’ll need to include the Schedule 1 taxes crypto form. On Schedule 1, Line 6a, you’ll report all capital gains from cryptocurrency transactions and other non-employment-related income sources such as gambling winnings and rental real estate incomes. Depending on how much profit you earn from crypto transactions, you may also have to fill out one or more additional schedules related to capital gains, such as Schedule D and Schedule 4, depending on your situation.

If You Fail to Register Taxes on Crypto, What Occurs?

Short-term penalties

If you fail to register taxes on crypto, the IRS can issue several penalties for not filing correctly or timely. Underpayment penalties vary depending on how late your payment is but typically range from 0.5%–25% of the unpaid balance each month.

In addition, late-filing penalty fees increase depending on how long you wait before filing your return. These fees generally range from 5 to 25% of your unpaid balance per month up to 25%.

Criminal prosecution

In extreme cases, failing to register crypto on taxes can lead to criminal prosecution. The IRS has a team of agents investigating potential violations of tax law and may bring charges against those who willfully evade their obligations by not registering crypto transactions in their tax returns. If convicted, taxpayers can face jail time, hefty fines, and other civil and criminal penalties — including having assets seized by the government.

Long-term impact on your credit score

In addition to short-term penalties and possible criminal prosecution, failing to pay crypto taxes or file a tax return can also impact your credit score. That can affect an individual’s ability to obtain loans or secure rental housing since lenders often consider an applicant’s credit history when making lending decisions.

When an individual doesn’t pay their taxes or files a return late, this information is reported directly to the Internal Revenue Service (IRS). This information may then be sent directly to credit bureaus, where it will appear in an individual’s credit report for seven years from the date the debt was assessed by the IRS (or longer if no payment was made).

Conclusion

Cryptocurrencies are still largely unregulated, making it difficult to know how they will be taxed. You can generally pay capital gains tax on any profits you make from selling cryptocurrencies and currency transaction tax if you trade them for another currency. If you use cryptocurrency to purchase goods or services, you may also be subject to sales tax. Cryptocurrency is not legal tender in most countries, so it is not subject to value-added tax.

You may need to pay tax reporting cryptocurrency if you earn income from cryptocurrencies. Keep all of this in mind as you consider whether investing in cryptocurrency is right for you!